“Exploring the Impact of M&As on the Biotech Industry!”

Hey biotech enthusiasts! 👋 Ready to dive into the dynamic world of mergers and acquisitions (M&As) in the biotech industry? Let’s explore how these strategic moves are reshaping the landscape and driving innovation in our field!

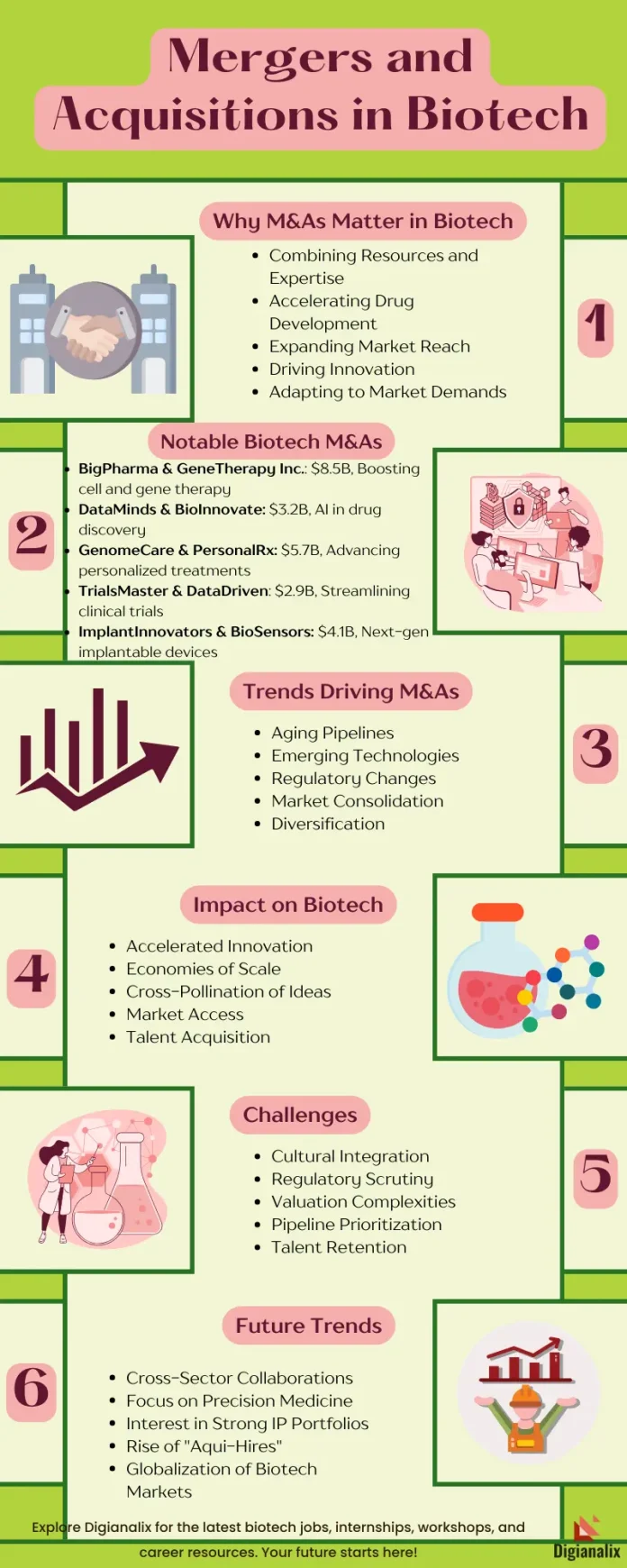

🔬 Why M&As matter in biotech

Mergers and acquisitions are more than just business deals – they’re catalysts for scientific breakthroughs and market disruptions. Here’s why they’re crucial:

- Combining resources and expertise

- Accelerating drug development pipelines

- Expanding market reach and product portfolios

- Driving innovation through synergies

- Adapting to changing market demands

🚀 Recent notable biotech M&As

Let’s look at some game-changing deals that have made waves in the industry:

- BigPharma acquires GeneTherapy Inc.

- Deal value: $8.5 billion

- Impact: Boosting cell and gene therapy capabilities

- AI-Bio merger: DataMinds and BioInnovate join forces

- Deal value: $3.2 billion

- Impact: Integrating AI into drug discovery processes

- Precision Medicine pioneers unite: GenomeCare and PersonalRx

- Deal value: $5.7 billion

- Impact: Advancing personalized treatment options

- CRO powerhouse formed: TrialsMaster acquires DataDriven

- Deal value: $2.9 billion

- Impact: Streamlining clinical trial processes

- Biotech meets MedTech: ImplantInnovators merges with BioSensors

- Deal value: $4.1 billion

- Impact: Developing next-gen implantable devices

💡 Trends driving biotech M&As

Several factors are fueling the current wave of mergers and acquisitions:

- Aging pipelines: Big pharma companies seeking new innovations

- Emerging technologies: Acquiring expertise in AI, gene editing, and more

- Regulatory changes: Adapting to evolving healthcare policies

- Market consolidation: Smaller biotechs joining forces to compete

- Diversification: Companies expanding into new therapeutic areas

🧬 How M&As are shaping Biotech’s future

These strategic moves are having far-reaching effects on the industry:

- Accelerated innovation: Combining R&D efforts to bring treatments to market faster

- Economies of scale: Reducing costs and improving efficiency in drug development

- Cross-pollination of ideas: Fostering creativity through diverse teams

- Market access: Helping smaller biotechs reach global markets

- Talent acquisition: Gaining access to top scientists and researchers

🤔 Challenges and considerations

While M&As offer exciting opportunities, they also come with challenges:

- Cultural integration: Merging different company cultures

- Regulatory scrutiny: Navigating antitrust concerns

- Valuation complexities: Accurately pricing biotech assets

- Pipeline prioritization: Deciding which projects to pursue post-merger

- Talent retention: Keeping key personnel during transitions

💼 What it means for biotech professionals

If you’re working in or considering a career in biotech, M&As can mean:

- New career opportunities and challenges

- Exposure to diverse projects and technologies

- Potential for professional growth and skill development

- Importance of adaptability in a changing landscape

🔮 The future of biotech M&As

Looking ahead, we can expect:

- More cross-sector collaborations (e.g., biotech-tech partnerships)

- Increased focus on precision medicine and rare diseases

- Growing interest in biotech companies with strong IP portfolios

- Rise of “aqui-hires” to secure top talent

- Continued globalization of biotech markets

What’s your take on the current M&A landscape in biotech? Are you excited about the potential for innovation, or concerned about industry consolidation? Share your thoughts in the comments below!

Stay informed about the latest biotech M&As and their impact on the industry by subscribing to our site. Let’s keep the conversation going and shape the future of biotech together!